Steve MacDonald of MacDonald Ventures: 5 Things I Need To See Before Making A VC Investment

Demonstrated ability to lead a team — We’ve all heard it before, a great team can make an OK product great, but a mediocre team will make a great product mediocre at best. When leadership fails, companies fail. It was one of the reasons I became an entrepreneur. The last company I worked for was the market leader. Growing nearly 20% per year and at its peak around $500 million in revenue. Management was horrible. 5 years after I left. The company was sold for $30 million.

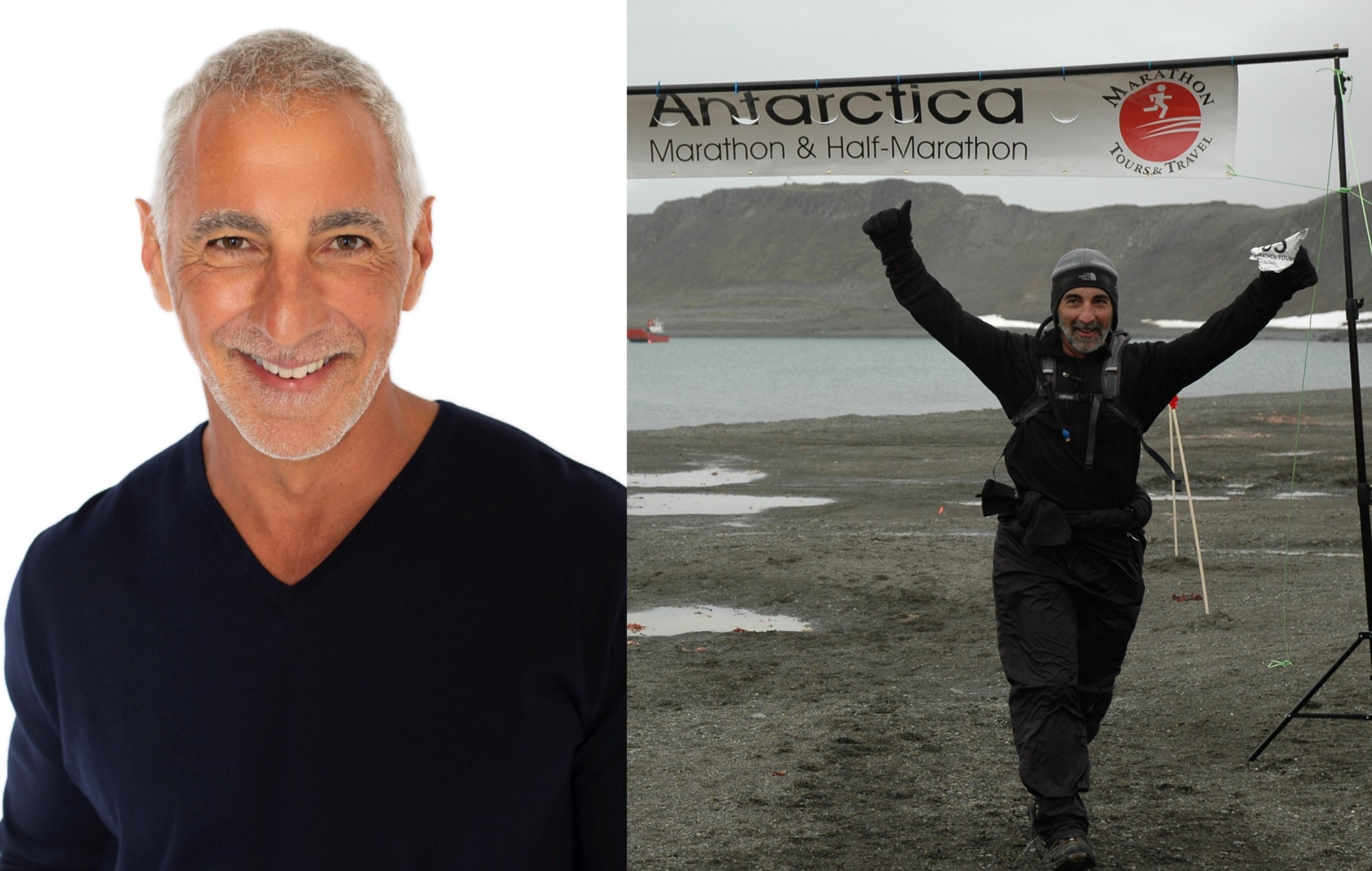

As part of our series about “5 Things I Need To See Before Making A VC Investment” I had the pleasure of interviewing Steve MacDonald.

Steve MacDonald is the Founder of MacDonald Ventures, a tech angel investment company dedicated to building leaders for a better tomorrow. He is heavily invested in the startup ecosystem of Tampa Bay, and a thrill seeker, disrupter, angel investor.

Thank you so much for joining us in this interview series! Before we dig in, our readers would like to get to know you a bit. Can you please share with us the “backstory” behind what brought you to this specific career path?

Iwas orphaned and adopted at 6 months old. I grew up in a trailer park in an orange grove. I’d watch Gilligan’s Island and Creature Feature re-runs. During summer break I’d stand in our front yard and play Horse (basketball) by myself for hours. I knew there had to be more to life than this. By my mid-twenties the internet came along and that was so much more interesting. I was always curious about new technologies, I’d gone to grad school for a couple years and was running a division of a publicly traded company. I was seeing all these 20 somethings on the cover of Fast Company and I wanted to be that guy. So I went out, raised $5 million of venture capital and started my first tech company. I never lost my passion for these technologies but, as with all companies, it required focus. Running a company to some degree limits your ability to be curious about a lot of things. So, once I sold my company, I knew that investing was a great mechanism to explore and learn about how the world would and is changing, and it provides a much deeper understanding than just reading about it or watching CNBC.

Is there a particular book that made a significant impact on you? Can you share a story or explain why it resonated with you so much?

There are 3; The first book impact was the existential novel “The Metamorphisis.” I was still in high school but the thought of losing my free will and waking up, trapped in a roach’s body terrified me. The book that freed me from that fate was Atlas Shrugged. It exposed me to the philosophy and the concept that “Wealth is the product of man’s capacity to think”…And “The 7 habits of Highly Influential People” because of the concept of the circle of influence.

Do you have a favorite “Life Lesson Quote”? Do you have a story about how that was relevant in your life or your work?

Another Atlas Shrugged quote, “The world you desire can be won. It exists…it is real it is possible…It’s yours.” Said in my own words “There is one and only one person that controls your attitude and your destiny, that’s you.”

How do you define “Leadership”? Can you explain what you mean or give an example?

Leadership to me is igniting the motivation people don’t even know they have and fueling that intensity as long as they remain in your circle of influence.

How have you used your success to bring goodness to the world?

I have tried to be intentional and mentor the people in my circle. I have tried to be a conduit for the lessons and experiences I’ve gained. I believe the more people I can inspire, the more that will go out and inspire others, thereby growing a positive circle of influence.

Ok, thank you for that. Let’s now jump to the main part of our discussion. The United States is currently facing a very important self-reckoning about race, diversity, equality and inclusion. This is of course a huge topic. But briefly, can you share a few things that need to be done on a broader societal level to expand VC opportunities for women, minorities, and people of color?

In the boardrooms and meeting rooms, there needs to be accountability. It’s growing but we aren’t there yet. But more broadly and societally, I’d like to see more attention on the examples of success of the heroes that have and are paving and building that future. I think positivity and stories of success are huge motivators. More success begets more success.

Can you share a story with us about your most successful Angel or VC investment? What was its lesson?

So far my most successful investment was a small investment in Ripple Labs. It was one of my first investments and validated my knowledge and assumptions on portfolio theory. It also taught me that I needed to learn a lot more about blockchain and other Fin-Tech technologies. That investment and knowledge led me to make several more successful De-Fi and fintech investments.

Can you share a story of an Angel or VC funding failure of yours? What was its lesson?

Without naming any names or companies I think it’s a common pit-fall. We invested in a company that had, what we believed, great technology and good traction, however all of us making the investment had concerns over the CEO. Those concerns bore out. Poor leadership. Argumentative. Poor financial acumen. Poor expense management. Etc. The CEO had to be removed. Lawsuits followed and way too much time was spent trying to save the investment when we should have just walked away.

Can you share a story with us about a problem that one of your portfolio companies encountered and how you helped to correct the problem? We’d love to hear the details and what its lesson was.

There was a company in a rapidly growing industry that was starting to see good traction but the founders couldn’t get along, they had no financial controls, there was no single source of truth, it was impossible to make any good management decisions because no one understood how and if we were making money which exacerbated the founder conflict. Although the founders thought they had clear roles and responsibilities, each of them spent more time criticizing the decisions of each other than actually working on their own roles and responsibilities. The first step was setting up a clear org chart and clear roles. The second was creating a system of OKRs that each of them and their managers were held to. 3rd, much to the aggravation of the founders, I brought in a controller and we created the proper business and financial controls. Then the pandemic hit. Sales plummeted but by that time we had a much clearer idea of where the business opportunity was. The business made a slight pivot, margins went from around 15% to 70%, sales have since doubled, one of the founders stepped down and the business is now cash flow positive.

Is there a company that you turned down, but now regret? Can you share the story? What lesson did you learn from that story?

A referral came from a highly respected and successful investor for a company called MUDWTR. It’s a mushroom drink to replace coffee. The investor had great experience with online advertising, CAC and LTV. The metrics were outstanding and it was the first investment in the company. I decided to let my wife try the product, if she liked it I’d invest. She didn’t so I passed. It’s now one of the best performing investments in his portfolio. Lesson is trust the numbers more than my wife’s palate.

Super. Here is the main question of this interview. What are your “5 things I need to see before making a VC investment” and why. Please share a story or example for each.

A large and growing TAM — With a large and growing total addressable market, it is easier to make mistakes and maneuver your way to a successful company. AirBnB was started as an idea for people to share an unused couch. At the time, the idea of letting complete strangers into your home was unheard of. Now, millions of people all over the world are willing to open their homes for rent. The addressable market has not stopped growing.

A unique perspective to a big problem — Having domain experience or expertise can be helpful but isn’t always necessary. It may be a personal problem or frustration but combine that with other unique insights or experience like marketing, operations, finance or other, an entrepreneur may look at a problem through a unique lens that incumbents have missed. Using AirBnB again, the founders didn’t come from the hotel industry but they had a unique personal insight.

Difficult to encroach on your moat — it may be that unique insight, your ability to out execute your competition (as demonstrated through previous experience), network effect, regulatory barriers or technical barriers. How much runway does your unique perspective, technology or other barriers provide you. I hear all the time “so and so can’t do this because they’re too big…” or some other naïve comment. They can and will if it’s compelling enough. But the harder it is, the longer it will take for them to be competitive. That’s the runway you have to win. Lots of investors passed on Uber, but the network effect of drivers and riders, regulatory barriers and Travis’ ability to execute made Uber one of the most successful startups of all time.

The founder’s ability to summarize their solution quickly and simply — I hear 100’s of pitches. I have a very short attention span. I also believe that simplicity wins every time. A founder’s ability to simplify a story to an outsider also spills over into how they build their product, communicate with employees, customers and other stakeholders and their general ability to execute better. Steve Jobs is the best example of this of all time. Over and over again, from the Mac, to the iPod, to the iPhone…his simplicity in design and communication led to one of the greatest technical revolutions and companies of all time.

Demonstrated ability to lead a team — We’ve all heard it before, a great team can make an OK product great, but a mediocre team will make a great product mediocre at best. When leadership fails, companies fail. It was one of the reasons I became an entrepreneur. The last company I worked for was the market leader. Growing nearly 20% per year and at its peak around $500 million in revenue. Management was horrible. 5 years after I left. The company was sold for $30 million.

You are a person of enormous influence. If you could inspire a movement that would bring the most amount of good to the most amount of people, what would that be? You never know what your idea can trigger.

A social media movement that brings positivity to the world and undoes the negativity brought on by the last wave of social networks.

We are very blessed that some of the biggest names in Business, VC funding, Sports, and Entertainment read this column. Is there a person in the world, or in the US whom you would love to have a private breakfast or lunch with, and why? He or she might see this.

Bill Gates. He’s a great innovator and now a great investor. He has a unique purview into lots of different and important technologies. He wasn’t always known as the best manager but evolved into a world leader making a lasting and important contribution to the world. It would be interesting to hear advice from someone like him for someone at my stage in life.

Or Bill Burr because he’s hilarious.

This was really meaningful! Thank you so much for your time.